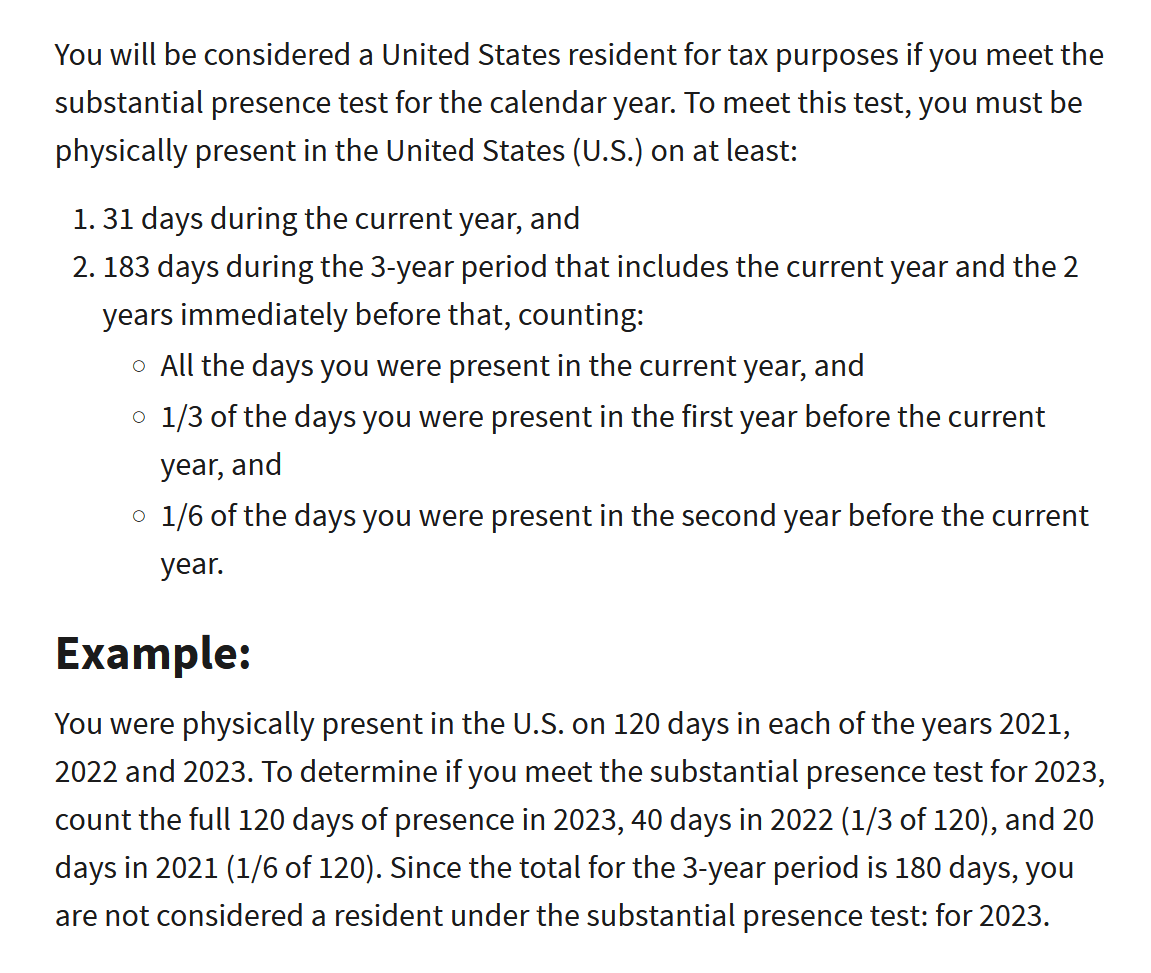

A nonresident alien should be aware of being deemed a US resident (and thus subject to US taxation) even if the nonresident alien is not a “US resident” for immigration purposes. This worse-of-both worlds, i.e. treated like a US resident for income tax but not for immigration, can be decided by what is known as the “substantial presence test:”

(Source: IRS.gov)

Here’s a hypothetical scenario where a digital nomad may get trapped by the “substantial presence test.”

Lukas, a suave digital nomad from Munich, Germany, decided to embark on a journey across the ocean. He’d been hearing a lot about the charm of Puerto Rico, the vivacious culture of Miami, and the unending hustle of New York. Given the flexible nature of his work in blockchain and software, Lukas thought it would be an excellent chance to explore these destinations while maintaining his income flow.

He started in Puerto Rico, enamored by its beaches and vibrant history, intending to stay for 60 days. However, he quickly extended his stay by another 30 days, completely taken in by the island’s allure. Next up, he touched down in Miami. The vibrant beach city kept him hooked for 70 sun-soaked days. By the time he reached New York, autumn was setting in, and he fell in love with its vibrant foliage, finding reasons to stay for another 60 days.

Lukas, being from a European country and traveling on a visa, never really thought he’d have to consider U.S. taxes. He was, after all, just a traveler with a laptop, working for European clients, and paying taxes in Germany.

However, Lukas’s prolonged stay had unwittingly set off a tax trigger. The Internal Revenue Service’s (“IRS”) “Substantial Presence Test” stipulates that if a non-U.S. citizen spends at least 31 days in the U.S. during the current year and a total of 183 days over a three-year period (taking all of the days present in the current year, one-third of the days in the previous year, and one-sixth of the days in the year before that), they can be considered a U.S. resident for tax purposes.

By the end of his trip, Lukas had spent 220 days in U.S. territories (Puerto Rico included), with 190 of those days being in the current year. Doing the math, his substantial presence was established. While he hadn’t earned his money from U.S. sources, his physical presence meant he was subject to U.S. tax regulations (subject to any potential exemptions, such as a tax treaty).

When Lukas got a notice from the IRS regarding his tax obligations, he was taken aback. His delightful journey had brought along an unexpected souvenir—a U.S. tax bill.

So, to our nonresident digital nomads friends out there: beware when planning on visiting the U.S. or any of her territories for any extended amount of time. But while you’re here, please feel free to contact Burrell Law in the event you have any business-related legal needs. As always, please seek out counsel of your choice when planning.